Your biopharma company is evolving. You have increased headcount, M&A activity, clinical activity, outsourcing activities or need more financial sophistication... and you realize you are outgrowing your current accounting software. This means balancing the need to invest in a more robust financial platform (think ERP) with the need to control costs as you establish a foundation for future growth and expansion. We often see companies charge into shopping mode, contacting software vendors to collect features and pricing. They end up implementing a solution that doesn’t meet expectations or puts constraints on future needs. The result: people blame the software and start shopping again for something new. With some diligence and planning ahead of time, these issues can be prevented.

Establish a Financial Platform Roadmap

When you’re moving from basic accounting software to an ERP, start by predicting and plotting cross-functional process and data needs at major milestones in your commercialization journey: IPO, positive Phase II and Phase III data, pre-launch and in-market success. Finance and accounting should work with technical operations, commercial, and IT as critical stakeholders. The needs and milestones can then be integrated into a financial platform roadmap that defines your anticipated business drivers (what you predict will occur and what you will need as your company progresses toward launch). Most importantly, this will define the requirements of the software you’re shopping for.

Consider Your Milestones, Only Implement What You Need

It is essential to consider your requirements as they will occur in your journey to commercialization. Without this perspective, it can be more difficult to differentiate between capabilities you need now versus those required for later milestones. For example, some vendors may propose extensive solutions that sound like they check every box from start to finish. But do you need to implement all of that right now? Our opinion is no, and doing so is not worth the financial risk. We recommend choosing a solution that will fulfill current needs and evolve with the business. Solutions with capabilities like:

- Multiple entity consolidations

- Licensing methods that encourage cross-functional participation

- Ability to scale from simple to robust procure-to-pay/manufacturing support

Our ERP for Life Sciences Checklist

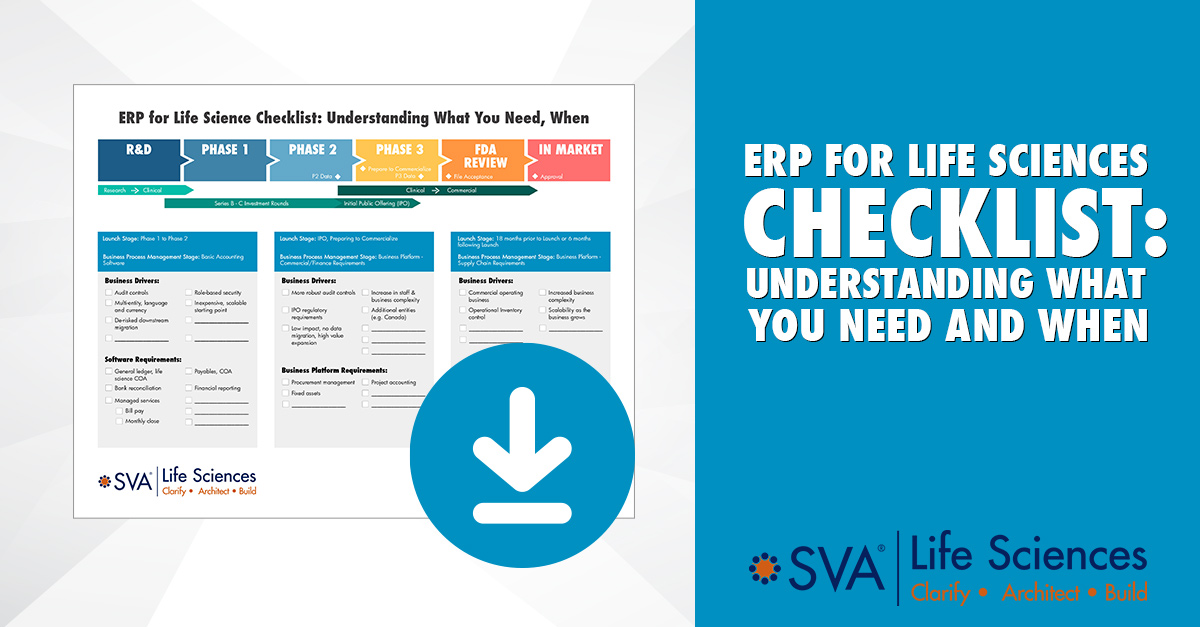

Selecting the right financial business platform solutions for highly complex and evolving emerging biopharma organizations requires specific expertise – not only in the life sciences space but in systems implementation as well. As part of the Financial Business Platform Design and Implementation services we offer, we partner with clients to create a unique roadmap using our ERP for Life Sciences Checklist. This checklist helps them visualize the typical industry progression of a financial business platform and understand specific drivers and service needs by stage in the launch journey.

Click below to download this free checklist. We are always interested in your feedback; contact Andrea Hayes hayesa@svaconsulting.com to learn more about ERP or other life sciences financial services SVA offers.

© 2021 SVA Life Sciences